In the emerging new Cold War between the US and China, it’s easy enough to slot some key global players onto one of the two sides. Russia stands with China. Japan stands with the US.

Where Europe stands is a key question mark. Long on the sidelines — much where President Xi Jinping has wanted — there are signs emerging that Germany, Europe’s economic engine, is undergoing a rethink about its trade and investment ties with China. The process is not dissimilar from the debate in South Korea this newsletter noted earlier this month.

German industry has no illusions about the danger of any fundamental shift, given its enormous reliance on the China market. Outgoing Volkswagen AG China boss Stephan Wollenstein underscored last month that Asia’s biggest economy remains key to the fortunes of the German auto giant, which counted on China for 40% of its sales in the first quarter.

But the political tilt in Berlin is palpable. German Foreign Minister Annalena Baerbock said last month she is “very serious” about reducing the German economy’s reliance on China.

Photographer: Pool/Getty Images Europe

And back in April, when Chancellor Olaf Scholz made his debut trip to Asia, he decided to stop first in Japan — a contrast with predecessor Angela Merkel, who put China first. Scholz highlighted that political symbolism was a priority in setting up the trip, saying in Tokyo that it was “no coincidence” his first trip as leader led him to that city.

Meantime, German lawmakers have pressed for greater scrutiny over their nation’s business ties with China. Despite industry lobbying, in 2021 they pushed through a supply-chain law that now requires companies to do due diligence on their suppliers, ensuring they don’t use slave labor — a move clearly targeted at China, amid concerns over practices in Xinjiang.

The Economy Ministry, led by Berbock’s Green Party colleague Robert Habeck, in May declined to renew investment guarantees for Volkswagen in China, over human-rights concerns, Der Spiegel and other media reported.

The increasing importance of geopolitics in Germany’s economic ties with China also hit home with the diplomatic spat between China and Lithuania. German firms that sourced products from Lithuania, including Continental AG, found their items held up in Chinese customs.

If a Baltic nation allowing Taiwan set up a representative office can end up disrupting German business operations in China, then it opens up a whole set of risks previously given little thought. One solution is to “localize” operations in China — effectively cordoning them off from overseas supply chains.

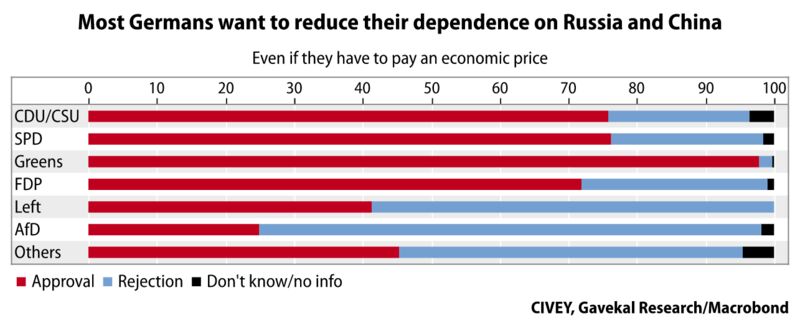

Germany Inc. is also facing a sea-change in terms of popular sentiment on the home front.

Even before the Russian invasion of Ukraine — which did China little favor in terms of public opinion in most democratic nations, given Beijing’s support for Moscow — a majority of Germany’s population had turned negative on the country. A survey by Forsa, a research institute, last year showed 58 percent wanted Berlin to take a tougher stance against China even if it affected economic relations with the nation.

Germany is expected to release a fresh strategic gameplan with regard to China later this year, and it will likely see the formal ditching Merkel’s approach of “wandel durch handel, or “change through trade,” says Yanmei Xie, a China policy analyst at Gavekal.

“How quickly the relationship changes will depend on how the argument resolves between Germans who favor values and strategic autonomy versus those who emphasize growth and profits,” she wrote in a note this month.

Source : Bloomberg